utah solar tax credit form

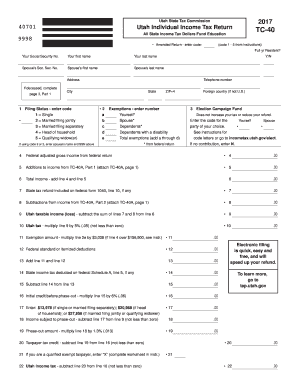

Utahgov Checkout Product Detail. Claim the credit on your TC-40a form submit with your state taxes.

How To Claim The Solar Panel Tax Credit Itc Everlight Solar

File for the TC-40e form you request this then keep the.

. After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach irs form 5695 to your. Total nonapportionable nonrefundable credits add all Part 4 credits and enter total here and on TC-40 line 26 Submit page ONLY if data entered. Get Access to the Largest Online Library of Legal Forms for Any State.

Basic Background Current form of Tax Credit from 2002 Provides tax credit to individual of 2000 or 25 of cost of the system whichever is. File for the TC-40e form you request this then keep the. Utahs Rooftop Solar Tax Credit Problem.

Renewable Energy Systems Tax Credit Application Fee. Welcome to the Utah energy tax credit portal. Install a solar energy system.

Claim the credit on your TC-40a form submit with your state taxes. Attach completed schedule to your Utah. Log in or click Register in the upper right corner to get started.

2020 Utah TC-40 Instructions26. Attach completed schedule to your Utah. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects.

262 rows Energy Systems Installation Tax Credit. To claim your solar tax credit in Utah you will need to do 2 things. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification.

Application fee for RESTC. UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things. This form is provided.

Create an account with the Governors Office of Energy Development OED Complete a solar PV application. To claim your solar tax credit in Utah you will need to do 2 things. Ad The Leading Online Publisher of Utah-specific Legal Documents.

If you install a solar panel system on your home in Utah the state government will give you a credit on your next years income taxes to reduce your solar. 1 Claim the credit on your TC-40a form submit with your state. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

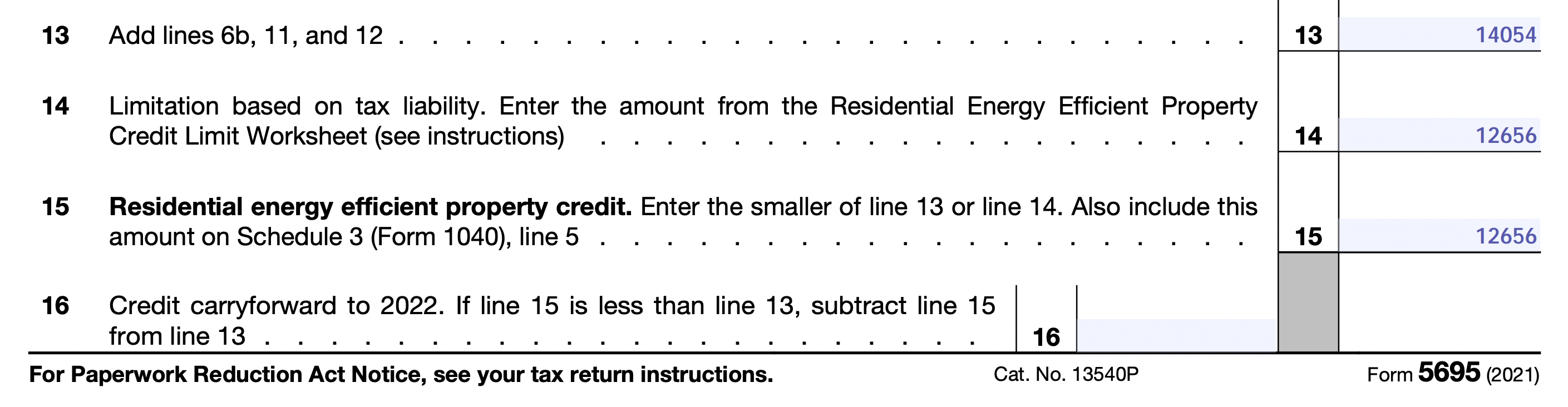

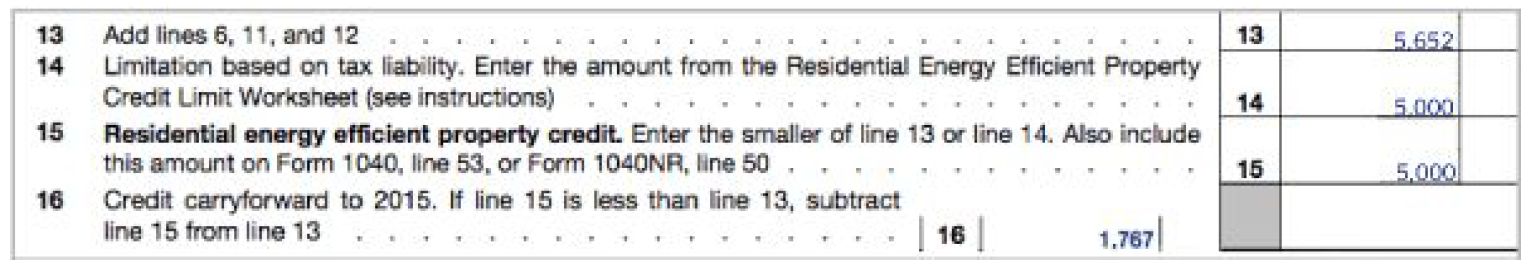

Attach TC-40A to your Utah return. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. You must claim Utah withholding tax credits by complet- ing form TC-40W and attaching it to your return.

We are accepting applications for the tax credit programs listed below. Renewable energy systems tax credit. Do not send W-2s 1099s TC-675Rs and Utah.

Steps for Utilizing the Utah Solar Tax Credit. Steps for utilizing the utah solar tax credit. A Secure Online Service from Utahgov.

Total nonapportionable nonrefundable credits add all Part 4 credits and enter total here and on TC-40 line 26 Submit page ONLY if data entered. From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations.

The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is. The utah residential solar tax credit is also phasing down.

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

![]()

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Life On Europa One Of Jupiter S Moons Jupiter Moons Jupiter S Moon Europa Space And Astronomy

Instructions For Filling Out Irs Form 5695 Everlight Solar

Tc 40e Fill Online Printable Fillable Blank Pdffiller

The Greatest Network The World Has Ever Seen The Global Internet Map New Scientist Internet Map Map Networking

Instructions For Filling Out Irs Form 5695 Everlight Solar

Tc 40e Fill Online Printable Fillable Blank Pdffiller

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Renewable Energies Concept Collage With Solar Panel Wind Mills And Electrical Energy Infrastucture Sponsor Energia Renovable Potabilizacion Toma De Decisiones

C A R Business Products Education Standards Book Publication Education

How To Claim The Solar Panel Tax Credit Itc Everlight Solar

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current